The Stock Exchange of Thailand (SET) recently announced its three-year strategic plan under the theme, “Towards Sustainable Growth and Innovation.” Under this plan, the SET aims to make innovation a key driver to ensure functionality and sustainable growth of the Thai capital market.

The strategy is in line with the Capital Market Development plan - approved by the Thai cabinet in September 2017 - which takes into account Thailand’s ageing society and the need for informal workers to gain access to post-retirement financial aid.

SET’s innovation strategy

Three broad strategies have been outlined through which, the plan would be executed.

The first is to strengthen core exchange businesses. This would be achieved by increasing the number of quality domestic and overseas SET-listed firms. Besides that, the SET plans to foster an “investment culture” via digital platforms which would provide easier access to investment knowhow. This would hopefully encourage long-term savings as the population in Thailand continues to age.

The second strategy is to create business opportunities for long-term growth by promoting investment in startups and small and medium enterprises (SMEs). This is aimed at helping such ventures, gain better access to funds via the innovative LIVE platform. The platform which was unveiled during the Startup Thailand event in July last year, is the first trading market place for startups in the country. The SET also plans to act as the regional source of funding via government-to-government (G2G) arrangements with the public sector to help Thai and foreign investors channel their funds to CLMV (Cambodia, Lao, Myanmar, Vietnam) economies via the Thai capital market.

The final strategy is to enhance infrastructure to boost the capital market’s competitive advantages at an international level amid an ever-evolving environment and technology disruption. Hopping on the blockchain bandwagon, the SET aims to utilise the technology to improve service efficiency to investors and listed companies. On top of that, it is also developing FinNet as an intermediary of settlement and upgrading the FundConnext platform so that investors can invest in multiple mutual funds fast and conveniently.

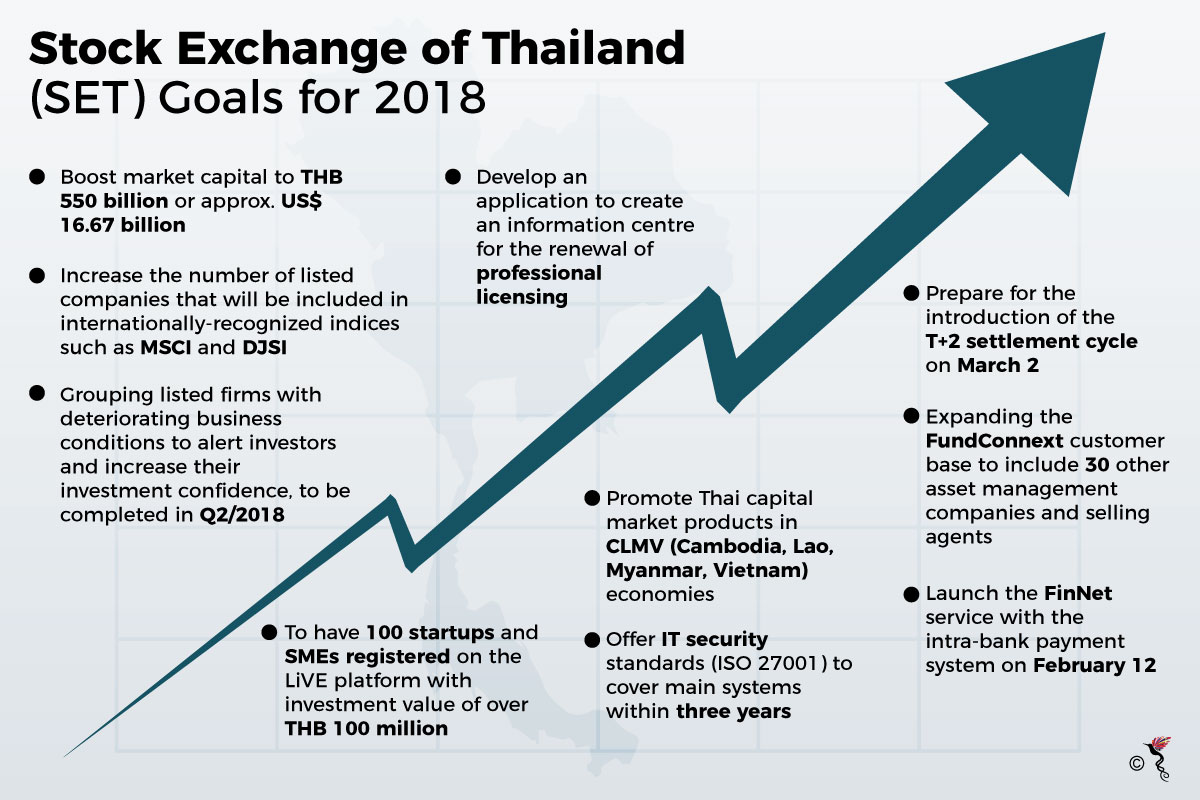

The SET has also outlined its milestones for the year.

A solid foundation to build on

Reflecting on the stock exchange’s progress over the years, President of the SET, Kesara Manchusree stated that the SET has been growing rapidly over the past few years and has emerged as the top market in the region in terms of liquidity and quality of listed companies. Moreover, amid the wave of technological advancements, he pointed out that it is a crucial moment for the SET to futureproof itself as it moves into a new investment environment.

Thailand’s stock exchange had a positive year in 2017. It ended the year with 1753.71 points, up 13.66 percent from the end of 2016. Its liquidity was ranked the highest in the ASEAN region since 2012 with an average trading value of THB50.11 billion (US$1.57 billion). Besides that, the combined market value of new Initial Public Offerings (IPOs) was the highest amongst the ASEAN-5 (Singapore, Indonesia, Thailand, Malaysia, Brunei) at THB426.35 billion (US$13.35 billion). It also received the Best Sustainable Securities Exchange Southeast Asia Emerging Markets 2017 award by London-based Capital Finance International magazine.

New year, new gains

In 2018, the SET got off to a promising start. It began the year with an all-time closing high since its inception in 1975, at 1778.53 points on the first trading day of the year. Combined market capitalization of the SET and Market for Alternative Investment stood at THB18.17 trillion (US$568 billion).

Manchusree in a statement, said that the rise “reflected investment confidence in line with economic growth and listed firms' profitability.”

The previous closing record was 1,753.73 on 4 January, 1994, when a combined market capitalization was at THB3.3 trillion (US$103 billion).

The SET also recently listed AIM Industrial Growth Freehold and Leasehold Real Estate Investment Trust worth THB1.55 billion (US$46.97 million) as its first IPO of the year on Tuesday.

Recommended stories: