Whispers of protectionism have now turned into screams and shouts.

But Associate Professor at the Lee Kuan Yew School of Public Policy at the National University of Singapore, Razeen Sally remains “guardedly optimistic” that the world would safely ride out the anti-globalisation wave.

“The bark has been worse than the bite,” he aptly surmised his thoughts on calls for more protectionist policies during The Regional Outlook Forum organised by Singaporean think tank, ISEAS – Yusof Ishak Institute on Wednesday (10 Jan). In essence, the world won’t reverse its collective globalist ambitions to the doldrums of the past circa the 1930s.

The backlash against globalisation was most pronounced in the immediate aftermath of US President Donald Trump’s election. The business magnate peddled an inward looking “America First” philosophy that proved incredibly popular with his support base. With that in mind, Trump set out to bring jobs and American companies back to the homeland, harden borders and halt the so called “theft of American prosperity.”

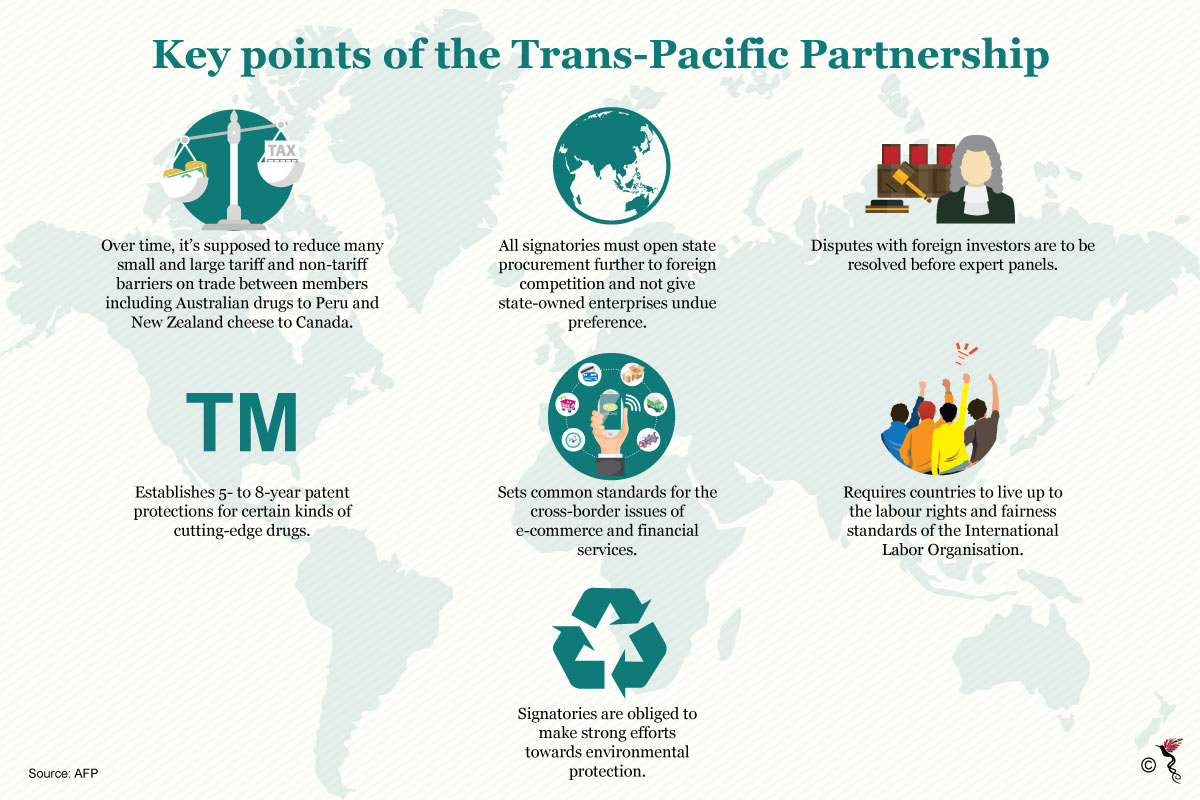

One of his first moves was to withdraw from the Trans-Pacific Partnership (TPP) – a move that initially crippled progress of the trade pact which consisted of countries in the Asia Pacific region. The deal included 40 percent of the world’s output. Trump's decision to pull out hurt potential businesses looking to gain entry into US markets (or vice versa) and damaged American credibility of its regional leadership role in Asia.

However, Sally who referred to himself as a “card-carrying free trader” played down the effects of creeping protectionism. Admitting that US rescindment from the TPP was a “strategic mistake,” he opined that in its original form, the trade deal was the most positive of its kind since the conclusion of the Uruguay Round which established the World Trade Organization (WTO).

As the TPP-11 continue negotiations without the superpower in its fold, Sally believes that a deal will be completed soon. Most importantly, it would be meted out such that the US would be able to re-join the treaty in a post-Trump environment.

Nevertheless, it’s important to also play devil’s advocate and imagine a worst-case scenario that could shake the post-Bretton Woods world we live in.

Over the course of this year, Sally pointed out a few things to watch out for – among others, North American Free Trade Agreement (NAFTA) renegotiations and WTO dispute settlements that could harm the fundamentals of the current liberal order.

The situation could turn murky now that Trump is after Canada and China – most recently slapping tariffs on Canadian softwood lumber and paper imports and threatening punitive duties against Beijing.

However, when push comes to shove, free-marketeers won’t go down easy. Large companies enmeshed in global supply chains would likely become the liberal force of good to ensure the sustenance of the very environment that permits their survival. The world as we know it relies on this complex interdependence that puts the iPhones in our hands and the Nike sneakers on out feet.

In the oft chance that the US relinquishes its leadership to the free world we have come to depend on, a new king might be crowned. China – which has arguably demonstrated a deeper commitment to free trade than America in recent times – looks poised to snatch that position. Chinese trade and investment have taken the world by storm – especially in this region with Chinese credit backing infrastructure projects in Cambodia, Lao and Malaysia, among others. The American Dream could very well be replaced by the Chinese Dream.

However, Beijing's actions must be viewed with caution too.

According to Sally, the Chinese banking system has seen a huge credit explosion but with that, comes the question of sustainability. Can Beijing keep its credit under control is anyone’s guess.

Estimates by the World Economic Forum in 2011 placed China’s debt at US$ 20 trillion in 2020, but as of 2016, it was at a worrying US$ 22 trillion. At this rate, its debt would be more than double its original projections, at a staggering US$ 50 trillion by 2020.

The tussle between globalisation and protectionism will continue to shape the fundamentals of the world as we know it. One thing is certain, our strong dependence on free market structures to live the comfortable lives we currently enjoy will continue to keep liberal trade alive. Nevertheless, complacency is a four-letter word in this environment, that the world simply cannot afford.

Recommended stories: