Due to their unregulated nature, cryptocurrencies and the businesses that they have created occupy a grey area in Southeast Asia. However, they have undoubtedly become a major focus area for ASEAN businesses.

This isn’t surprising, considering the advantages that cryptocurrencies bring to the table. Their adoption can reduce costs and increase security and convenience for both consumers and businesses.

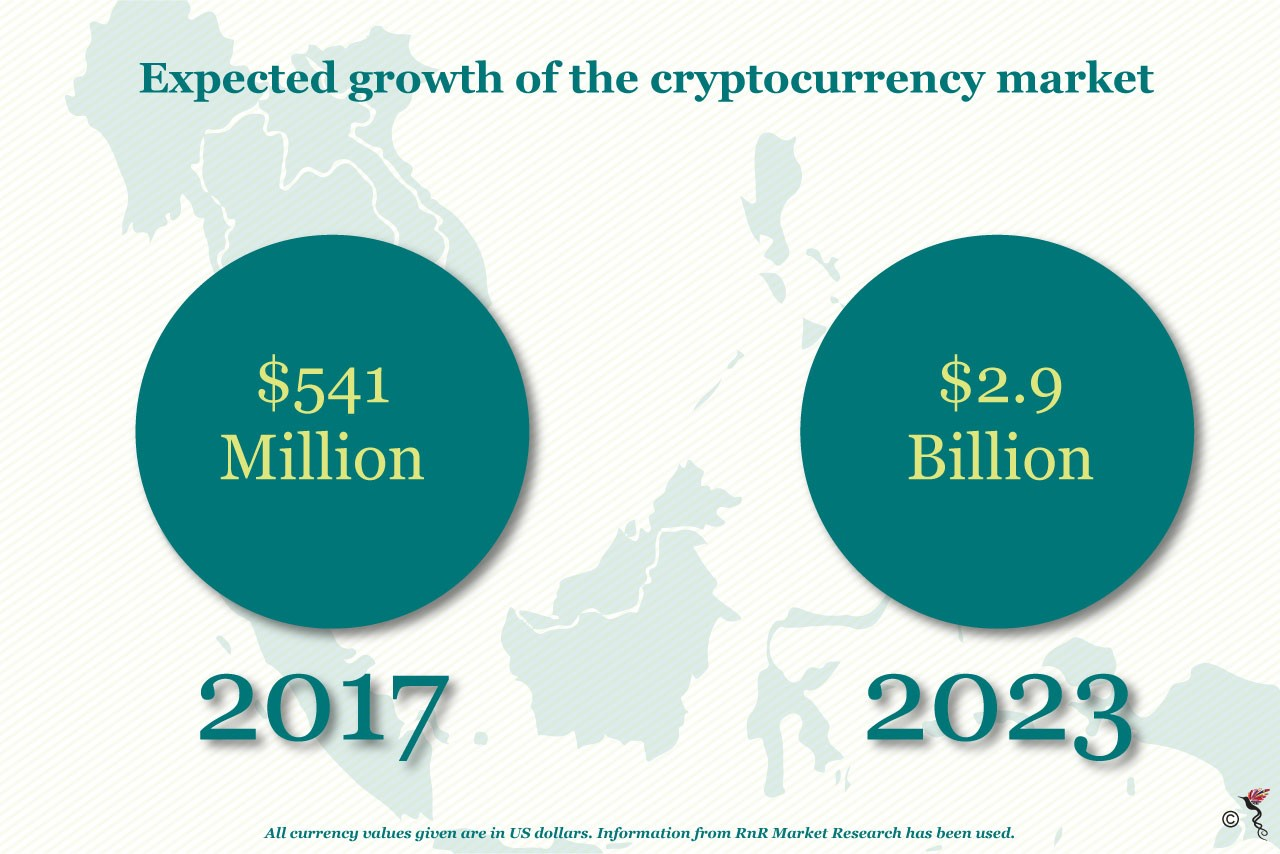

The cryptocurrency market is expected to see massive growth over the next six years. Currently valued at 541 million dollars, its compound annual growth rate is projected to be 32.31 percent. That places the market value at 2.9 billion dollars in 2023.

So, what are some of the interesting services that are using cryptocurrency technology in Southeast Asia? Read on below to learn about a few of the companies that are changing the way business is done.

Expected growth of the cryptocurrency market.

Coins.ph

Filipinos who work abroad send over 26.9 billion dollars back home every year and this money is an integral part of the country’s economy. Unfortunately, remitting money back home has traditionally been an inconvenient and time-consuming affair. People often had to deal with long queues and high charges at remittance centres.

In a bid to disrupt this sector, a few companies have set up with blockchain and cryptocurrency in mind.

A major player is Coins.ph, a platform that allows overseas workers to send money back home, and users living in the Philippines pay their bills and for other services. It currently has over one million users.

Financial transactions aren’t the only thing made more convenient by a platform like Coins.ph. It also saves time that would have been spent in line at a brick and mortar remittance centre. The company claims to have saved Filipinos 2.8 centuries worth of time spent queuing since 2014.

FundYourselfNow

Sites like Kickstarter have made crowdfunding accessible, and popular, to the masses. It is an industry that is well-suited for cryptocurrency integration.

FundYourselfNow – a crowdfunding platform created in Singapore – allows backers to pay using cryptocurrency. The platform also enables milestone-based payments for backers, creating more accountability for project owners and allowing backers to delay payments or get their money back if major milestones aren’t met. This cancels out a great source of worry from backers, some of whom will have dealt with unfinished or fraudulent Kickstarter campaigns.

Pundi X

One of the stumbling blocks to widespread cryptocurrency adoption is ease of access. Startups like Indonesia’s Pundi X aim to fix this by providing shops, restaurants and other merchants with a device that allows them to trade cryptocurrencies easily.

Pundi X aims to distribute between 100,000 to 700,000 devices in its key markets over the next three years. If they manage to reach this goal, it could give millions of people the ability to buy and sell cryptocurrency as easily as they would be able to buy a chocolate bar.

Recommended stories: