Based on Bloomberg’s New Energy Finance "New Energy Outlook" report, solar and wind power generation will dominate the future of electricity where 72 percent of the 10.2 trillion dollars spent on new power generation and installation worldwide between now to 2040 will be invested in new solar photovoltaic (PV) plants and wind parks.

Although there has been rapid installation of solar energy systems in the region, wind energy has been a relatively low priority renewable sector in ASEAN. The best wind potential (in terms of meter per second of wind velocity), lies in the northern parts of Vietnam, Cambodia, Myanmar and Lao. The Philippines and Thailand also has a considerable amount of wind potential as well. More importantly, only the Philippines, Thailand, and Vietnam have taken substantial efforts to promote the wind energy sector in their countries.

In this picture taken on May 2, 2014, shows fishermen working near the first towers of wind turbines from Vietnam's first wind power plant along a sea coast on the southern coastal province of Bac Lieu, Vietnam. (AFP Photo/Duy Khoi)

At present, according to the Department of Energy, the Philippines has an operational wind energy of 426MW, one of the highest in Southeast Asia. The country enjoys this distinction because of its strategic location where international financial institutions (FI) like the World Bank and Asian Development Bank have regional offices. These international FIs provide loans to countries of the world for capital programmes relating to social and economic development.

Thailand on the other hand has the Electricity Generating Authority of Thailand (EGAT) which is the single buyer of bulk electricity. Under terms and regulations set by the Energy Regulatory Commission (ERC), this is to ensure the best interests of public consumers, energy resource optimisation, and fairness to all. The Thai electricity supply industry is based on a state-owned enhanced single-buyer scheme which pulls the grid to the renewable energy developer thus also playing a healthy role as an enabler.

More recently in 2011, Vietnam joined the foray, after years of delay and announced its wind power targets following a much-awaited roll out of the Feed-in Tariff (FiT) programme. Industrialisation and urbanisation in Vietnam is also big factor to why this country has a promising RE potential not only for wind due to the increasing demand for power.

Advantages of wind energy market in Thailand, Philippines and Indonesia

Increase of wind capacity will contribute to higher share of renewable energy in the overall energy mix, thus increasing energy security and reducing carbon dioxide emission. Unlike other types of power plants, wind energy emits no air pollutants or greenhouse gases.

According to Bloomberg’s New Energy Finance Southeast Asia Analyst, Abhishek Rohatgi, in an e-mail correspondence with The ASEAN Post, “the obvious advantage is to help shift the power system to a cleaner future and help these countries to reduce emissions. Besides this, if domestic market is competitive, new wind plants could be cheaper than new coal or gas plants and hence result in lower power purchase tariffs by the utilities.”

Feed-in-Tariff Mechanism – The Enabler

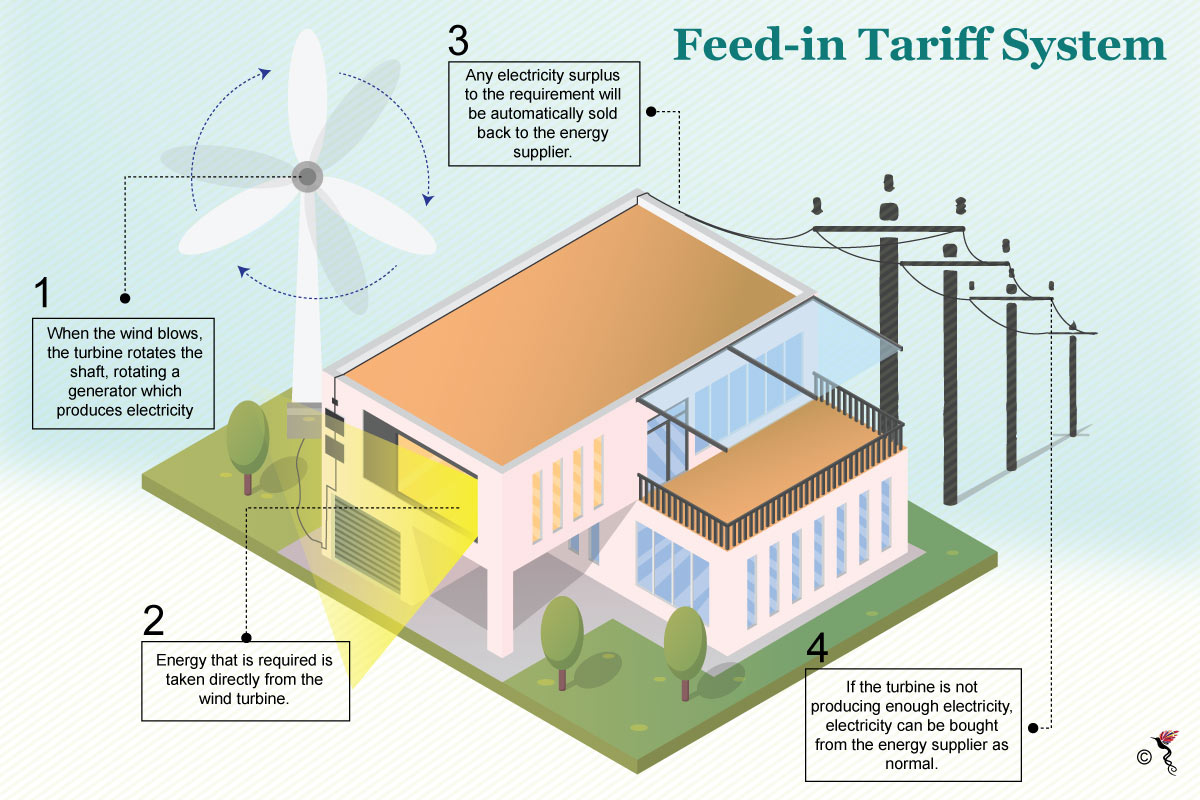

The Feed-in-Tariff system (FiT) is a scheme typically introduced by a sustainable development energy authority (as is the case in Malaysia) or a utility provider (as is the case in Thailand) to encourage the deployment of renewable energy systems. The FiT scheme allows an eligible producer of renewable energy to a guaranteed payment through a renewable energy power purchasing agreement (REPPA) executed between the renewable energy developer and the respective authority or utility provider, at a fixed rate for each kilowatt-hour of energy it supplies to the national grid.

Han Phoumin, Energy Economist of ERIA (Economic Research Institute for ASEAN and East Asia) explained in an e-mail correspondence with The ASEAN Post, that FiT was a major incentive under the Philippines Renewable Energy Act 2008. In addition to this, the implementation of the net-metering scheme, a non-fiscal incentive also allows consumers to generate their own electric power and deliver excess supplies back to the electric grid to offset their electricity consumption. The approved FIT for wind energy was at a rate of US$0.1486/KWh.

He added that Vietnam plans to increase its wind energy capacity in the national energy mix up to 800 MW by 2020; 2,000 MW by 2025 and 6,000 MW by 2030 as stated in the energy policy of Vietnam. However, the concrete policy to promote wind energy such as a FIT or other measure has yet to be released.

On the other hand, Abhishek noted that “Thailand and the Philippines have already stopped awarding new projects based on fixed FiTs. Both of them are moving towards competitive tenders. It is quite likely that Vietnam will start to consider competitive tenders for wind as discussions have already started for auctions in the solar industry. Auctions, if properly designed, could help governments determine the correct market price of renewable projects and hence, could be a good way forward for the ASEAN region.”

“Auctions and tenders need to attract sufficient number of developers and must allow developers to count in all market risks, without which they may not be able to attract enough interest as we have seen in Indonesia,” he elaborated.

Feed-In Tariff mechanism.

Challenges faced in deployment of wind energy in Thailand, Philippines and Vietnam

Although, these markets enjoy massive potential but they are also lumbered with challenges. One of the biggest problem faced in deploying wind energy systems in these countries is having a balance between financing the project and a business model that works.

According to Abhishek Rohatgi, “beyond the Adder approved wind projects, Thailand does not have clear policies to support the wind development. Current hybrid power purchase agreement is unlikely to see interest from project developers as the projects need to follow the specific capacity factor requirements.

He added that “the Philippines stopped awarding FiT to wind projects after its capacity quota was full by end of 2015. The much-awaited Renewable Portfolio Standards policy is delayed and is now expected only in 2018, without which it is difficult to implement a wind project in the country.”

As for the deployment of wind energy in Vietnam, he states that the “current wind FiT is considered low and government is considering to revise its wind FiT to $8.7/kWh for onshore and $9.9/kWh for nearshore projects. This might spur new projects in high wind resource areas, provided the power purchase agreement is bankable.

Additional challenges include more thorough research into newer technology and energy systems which are necessary to lower costs, increase reliability and optimise energy production and efficiency with lower heat losses (electricity losses). Other issues include mitigating known environmental impacts such as noise pollution, avian mortality, and climate change in the long run. If these challenges can be resolved in the near future, Southeast Asia could be a force that drives the development of renewable energy, particularly wind power, in the world.

Recommended stories: